TBC Capital: checking in on the recovery’s macroeconomic vital signs

In its macro-sectoral overview published in mid-September, TBC Capital takes a look at some of the most important vital signs of the Georgian economy and checks in on some of the financial tendencies of the recovery following the initial shock of the coronavirus pandemic. Investor.ge, in partnership with TBC Capital, presents some of the main highlights of the report.

COVID-19 spread dynamics, tourism expectations

After an initial summer lull, the spread of the virus has accelerated in Georgia as it has in a number of other countries, the report notes.

On the flip side, improved treatment methods have led to lower fatality ratios in developed countries, and the vaccine is expected to become available in the coming months, with nine candidates in the final stages of development in phase-III human trials, and the vaccine is expected to be widely available in late 2020 or early 2021, with the US CDC having already notified local officials in all states to prepare for vaccine distribution for high-priority groups as early as November 1, 2020. Meanwhile Georgia has already registered to receive as many as 700,000 doses from the Global Vaccine Alliance once a vaccine is approved.

These events point to a likely significant recovery in tourism sometime in the second quarter of 2021, TBC Capital forecasts, though notes inflows will remain around 50% down compared to 2019; a return to pre-crisis levels of passenger flows is forecast only for the beginning of 2022.

By the end of 2020, TBC Capital expects tourism will have dropped year on year as much as 83%, noting that while Remotely from Georgia – a government program meant to attract freelancers to travel and work from Georgia – may provide some cushioning if the global situation further deteriorates, it will likely have a limited immediate impact.

Key macro parameters

GDP growth is expected to drop within the range of 5.0-5.5% in 2020, however given increasing infection numbers, without an additional fiscal stimulus the growth outlook for the year is moving towards the lower end of the range, though the economy is still expected to recover in 2021. Fiscal stimulus will remain a major driver until the recovery of tourism.

But there’s quite a bit of good news this month too: TBC Capital has revised upwards a number of macro parameters towards positive trends.

The labor market has proved more resilient than expected, with the number of employees decreasing by just 2% YoY in Q2 2020. Among the more affected sectors are arts and entertainment, professional services and HORECA. Overall, employment is recovering, having posted 1% QoQ growth in Q2 2020.

In its August report, TBC Capital previously forecasted a decrease in FDIs for 2020 as low as -55%; while in September, this number has been revised upwards to -35%.

Credit growth has been stronger than earlier expected with increased GEL lending, and inflation is also decreasing more strongly than expected, with an expected return to the 3% target by the end of 2020.

However, the report notes, inflationary pressures can build up again quickly if there should be further depreciation in the GEL.

By December 2020, given the relative stability of the currencies of Georgia’s main economic partners against the USD, the USD/GEL exchange rate is expected to stand at around $1/3.15 GEL.

Expected impact on the business environment

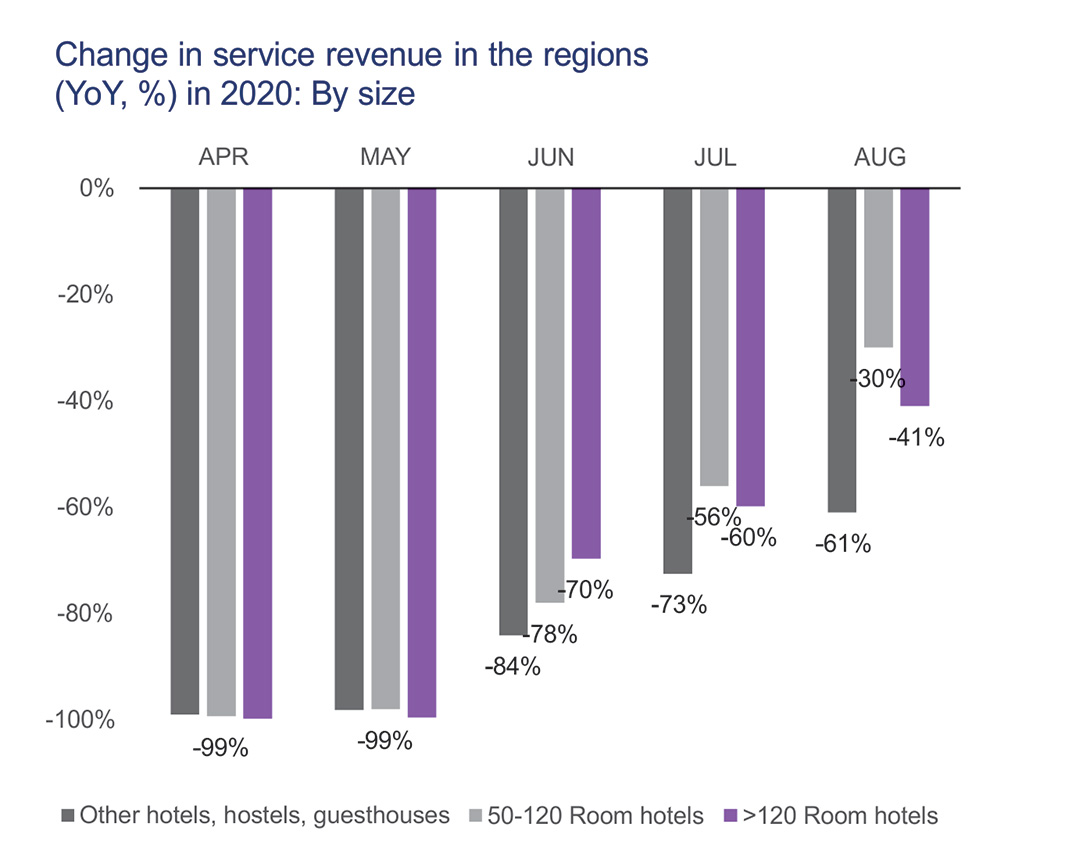

The recovery in the hospitality sector continued in August, with growth more visible in the regions (-49% YoY in August, compared to -59% in July).

Large and medium size hotels display dynamics that are more positive; turnover in Adjara hotels improved significantly in August (-45% YoY, compared to -54% in July), while performance was more modest in all other regions. The recovery has been the smallest in Tbilisi and Kvemo & Shida Kartli.

YoY change in transactions in the residential real estate sector stood at -17.4% in August, up by circa 1pp compared to July. New apartment sales were down just 12% YoY in August, a significant improvement compared to the 22% decline in July. Prices in USD continue to decline for old apartments (-4.1% YoY) and increasing for new properties (+1.0% YoY), as demand started to shift to new units. As of 8M 2020, real estate sales have decreased by -35% YoY.

The government’s mortgage subsidy program has been of assistance here: since July 6, 38% of mortgages were beneficiaries of the state subsidy program, according to TBC internal data.

Among surveyed companies in the commercial real estate sector, shopping malls continue to face more declining revenues than street retailers. In the sector the overall rent income is expected to decrease by 20-25% in USD throughout the year.

In construction, in Q2 2020, a sharp decline has been observed in the construction turnover of residential and non-residential buildings (-34% YoY). Infrastructural construction remains more resilient (2020 6M +1%). Total construction turnover is expected to decrease by -15% YoY throughout the year.

Meanwhile, the FMCG sector is expected to sustain 2019 levels in 2020 in nominal terms, with a growing share of the organized market. Revenue is expected to remain broadly the same in 2020, with losses from tourism (570 million GEL) and restaurants (180 million GEL) compensated by increased consumer spending (750 million GEL).