Unlocking Georgia’s solar power investment potential

Georgia’s solar energy market is gathering momentum, supported by falling global costs and rising investor interest. While grid capacity and regulatory processes still present challenges, the fundamentals for future growth remain strong, according to TBC Capital’s latest sectoral report.

Solar trends surge globally

Solar energy has emerged as the largest renewable energy source globally in terms of installed capacity, representing 42% of total global renewable capacity at the end of 2024. However, this figure doesn’t tell the full story. “We always have to underline that this is in terms of installed capacity—not generation,” notes Vice President of Research at TBC Capital Andro Tvaliashvili. “The actual electricity generation from solar is still far behind hydro, largely because of efficiency differences.”

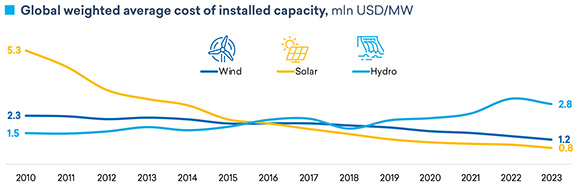

What solar lacks in efficiency, though, it has more than made up for in affordability. “Prices have dropped dramatically over the past decade,” says Tvaliashvili. “In 2010, the cost to install 1 MW of solar capacity was around $5.3 million. By 2023, that had fallen to just $800,000. And in Georgia today, we’re looking at around $445,000 per MW.”

The primary reason behind this sharp drop? Module prices. “In 2010, solar modules cost around USD 2.4 per watt,” Tvaliashvili explains. “By mid-2024, that fell to USD 0.25—and now it’s down to just 10 to 12 cents per watt globally.”

As solar scales up globally, energy storage is becoming a critical complement—particularly for utility-scale plants. “If you want to connect a large-scale solar plant to the grid, storage is necessary,” says Tvaliashvili. “It’s needed to main-tain grid stability, especially given how volatile solar generation is.”

The good news is that much like solar technology, the cost of constructing energy storage systems has also fallen significantly—dropping from around $2.51 million per MWh in 2010 to approximately $270,000 per MWh by 2024, making integrated solar-plus-storage projects increasingly viable at scale.

Georgia’s electricity generation

Over the past decade, electricity generation in Georgia has grown at an average annual rate of 3.2%, just slightly outpacing consumption growth of 3.1%. That balance is now under pressure. “What’s important to understand is that we don’t expect this to be sustainable,” says Tvaliashvili. Demand is expected to accelerate both externally and domestically, in part due to more EVs, widespread use of air conditioning, and real estate development.”

Seasonal and regional dynamics further complicate the picture. “Georgia still imports a quarter of its electricity when you account for seasonal gaps and reliance on thermal plants powered by imported natural gas,” he explains. This makes local, clean generation capacity—like solar—a strategic imperative. “Even if you put aside ESG concerns, from a pure economic standpoint, reducing our dependence on imported energy makes sense.”

Solar investment opportunities and challenges

Investor appetite for solar in Georgia is strong. TBC Capital’s report shows that proposed solar projects total 5.5 GW—a figure that vastly exceeds the 500 MW grid connection cap currently in place through 2028. Fully realizing this high interest at once is unlikely in the near and medium term, says Tvaliashvili.

In addition to grid limitations, land access poses another major constraint. “The risk profile for solar is lower than hydro, but it’s still not without challenges,” says Tvaliashvili. “Public land is often used informally by communities for cattle grazing, which can create social tensions even when no formal ownership exists.”

Location also matters from a technical and financial standpoint. “Connecting to the grid requires proximity to substa-tions. If your site is 20 kilometers away, transmission costs rise and efficiency drops,” he notes.

Despite these hurdles, the fundamentals for investment in solar energy remain compelling. “Prices are low, risks are lower than hydro, and the technology is simpler to deploy,” says Tvaliashvili. “You don’t need to build massive infra-structure.”

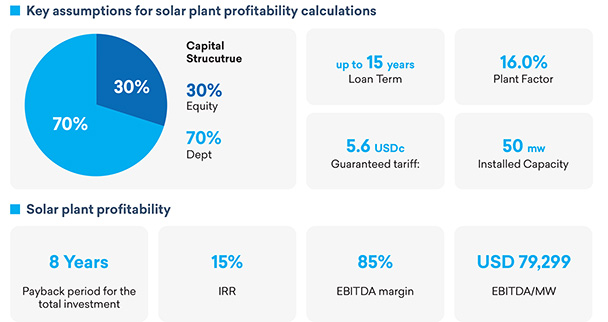

Recent auctions also indicate profitability is feasible. “We looked at the economics of a hypothetical 50 MW plant and found that the numbers look healthy,” he adds. “The median price from Georgia’s most recent Contracts for Differ-ence (CfD) auction—USD 5.6 cents per kWh—is workable given today’s input costs.”

Perhaps most encouragingly, Georgia’s experience with small-scale installations has helped build market readiness. “Even though we haven’t done utility-scale yet, we now have local companies with hands-on experience in solar,” he says, noting that as of April 2025, a total of 220 MW solar power stations have participated in the state’s net metering program. “That’s definitely a positive step forward towards building utility-scale solar power plants in Georgia.”