The rising stake of meat production in Georgia

Meat is good business in Georgia, and it is going to get even better. So say the researchers at Georgian investment bank Galt & Taggart (G&T) in a report on the industry Meat & Meat Products in Georgia, and they add that there is significant potential for new enterprises. A key indicator is the large amount of meat that is currently imported: Georgia is only 50% self-sufficient, giving plenty of opportunity for import substitution.

Another reason for forecasting enterprise growth in all meat sectors is the low level of industrialization in the industry. In the latest production figures, family farms are shown as supplying 85% of locally produced pork, 86% of beef, and 26% of chickens, with the total value put at 232 million GEL ($86 million, as of late March 2024).

“There are over 250 registered and active enterprises, among which only 20 are large or medium-sized, most of them producing poultry and eggs,” comments the Meat and Meat Products report. Chirina is by far the largest, with around 13% of the market in 2021, followed by Koda (8%), Kumisi (7%), and Dila and Noste (both 6%).

G&T gave the figure for annual meat consumption as 1.5 billion GEL in 2022, of which about a third is processed, a rise of over 25% in the previous year – although much of that was price increases. International research group Statista expects that the consumption figure will rise to 1.8 billion GEL this year, forecasting annual growth of over 7% for the next few years.

Growth opportunities

Where do G&T see the growth opportunities? All over the industry, it seems. In new production enterprises, as meat production is relatively undeveloped; in vertical integration by retailers; and in warehousing, cold storage, and distribution. Poultry, in particular, is expected to see increasing demand, in line with global trends.

Both the Georgian government and major donors have been trying hard to overcome the many hurdles to growth in production, including the crucial lack of husbandry skills necessary for successful livestock rearing. Other challenges, as listed in a PMO Business Consulting report a couple of years ago, range from lack of pasture management, lack of vets, unproductive cattle breeds, and low competence among small farmers in terms of effective management practices.

Cattle rearing, especially, is much more demanding than for poultry. Reflecting this, as well as demand, GeoStat’s third quarter numbers last year showed poultry numbers rising – up 13%, but cattle and pig numbers fell by 38% and 21%, respectively. To back their agricultural education programs, the government and donors have provided a wide range of grants to help small farmers.

In support of U.S. Department of Agriculture (USDA) assistance for Georgia’s dairy and beef industries, new U.S. Ambassador Robin Dunnigan made the Georgian Cattle Expo 2023 last autumn one of her first official visits. USDA has been advising on how to improve the food safety, productivity, and quality of Georgia’s dairy and beef value chains. The Cattle Expo serves as a business-to-business venue for farmers, livestock input suppliers, and dairy and beef processors and marketers.

The EU is a major donor providing financial and technical assistance to the agri-food value chain through its neighborhood program ENPARD. With a budget of EUR 180 million over the period 2013-2022, the program allocated significant resources to finance rural development projects across Georgia. An important objective of ENPARD has been to strengthen cooperation among small farmers, and the program has provided more than 280 cooperatives with direct funding and technical assistance.

Consumption and production

Georgia’s regional cuisine may be chock full of vegetable dishes, but it does in fact consume more meat than the global average – its annual per capita consumption being 38 kilos, yet that is far below Europe’s 63 kilos and North America’s 99 kilos. Despite Georgia’s pride in its cuisine, however, it is processed meat consumption that is forecasted by G&T to rise the most, with a gain of 8% between 2023 and 2027, against 5% in primary meat products.

“This growth is expected to be fuelled by the rising purchasing power of the population and the expanding tourist industry,” says G&T analysts in Meat and Meat Products.

Global consumption of poultry overtook that of pork in 2016, “the shift attributed to the affordability of poultry…and its health benefits and ease of preparation,” states the Meat and Meat Products report. The consumption split is now poultry 40%, pork 34%, beef 21%, and sheep and goat 5%.

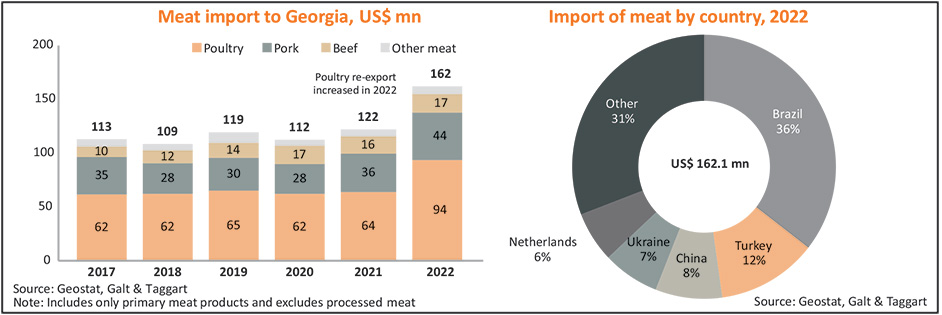

One good reason for Georgian optimism about prospects for domestic companies and local farming is that meat imports have been rising and were up 35% in 2022 at $187 million. While Georgia is 50% self-sufficient overall, the figure for poultry is only 34% and pork 48%, both of which are bigger volume markets than beef. Its regional peers have more developed meat industries, with Armenia 71% self-sufficient and Azerbaijan 88%.

Local production in primary meat products overall totaled 74.6 million kilos in 2022, while net imports were slightly more at 74.9 million kilos. The split in processed meat was 37.2 million kilos produced locally and 6.4 million imported. The majority of meat imports come from Brazil (36% of the total), with frozen poultry and pork the primary products, both sectors in which Georgia already has established domestic enterprises, particularly so for chicken. Turkey, China, and Ukraine are the next largest sources of meat, at 12%, 8% and 7% of the total, respectively.

Georgia is also seeing considerable export increases, although the sums are relatively small, with a gain of 58% to $46 million. “About half the exports are re-exports of frozen meat. The main export markets are neighboring and mostly former Soviet countries (Armenia 44%, Turkmenistan 20%, and Azerbaijan 20%). Until 2020, there was high demand for sheep meat from Middle Eastern countries (e.g., Iran, United Arab Emirates, and Kuwait), which was later replaced by the export of live sheep,” states the report.

Processed meat is more strongly developed as a Georgian industry, with 85% of consumption produced locally, and its growth has been an annual 3.8% in recent years. Deli meat is the largest sector, at 46%, followed by sausages (33%) and bacon (6%). The top three companies, which have between them 40% of the market, are Liderfood (16%), Nikora (15%), and Karida (12%). However, the net profit margin has become progressively less attractive, falling from 2012’s 14% to 4.9% in 2021.

Development support

For years now, the government and U.S., EU, World Bank, and UN aid programs have focused on trying to increase Georgia’s food self-sufficiency, spending hundreds of millions of dollars – with dairy and meat being prime targets. The government has set up an Agriculture Investment Fund to support the sector by providing credit to farmers, and there are programs being implemented through the Rural Development Agency, such as Plant the Future and Preferential Agrocredit.

Recently, the Asian Development Bank announced a $25 million program with Credo Bank, with a specific focus on targeting women borrowers in agricultural production, processing, and trade. “Women account for over a third of the country’s agricultural employment and agricultural holdings ownership, but remain underserved in terms of accessing financial assistance,” said ADB Director General for Private Sector Operations Suzanne Gaboury. “Additionally, this project will promote domestic food production and import substitution to enhance the food security of Georgia.”

As the U.S. International Trade Association’s website tells its local businessmen who are looking at Georgian food production as the economy expands, there is huge scope, in theory at least, as the country still imports 70% of its food overall. However, it also states that there are a lot of obstacles to be overcome, ranging from the paucity of commercial farming and large amounts of land either not being farmed at all or owned in tiny parcels by households, to the aforementioned shortages of cattle and dairy farming skills.

While the importance of farming in GDP has declined sharply – in the early 1990s it made up 60% of the economy – almost half the population is still dependent on it. However, the young are leaving, often migrating abroad. A survey a few years ago showed that only 3% of those farming derived significant income from it, but the scope for improvement is indicated by the figures showing that the financial returns in Armenia were over three times higher.