TBC Capital || Retail grocery stores gaining market share

TBC Capital’s latest fast moving consumer goods (FMCG) report shows the market is steadying after years of one-off disruptions. While competition between store chains remains high, growth in the so-called organized market—established retail market brands—is gaining against the unorganized market, or family-owned shops and open markets. This trend is expected to continue in 2024 largely due to regional expansion.

Market stabilizing

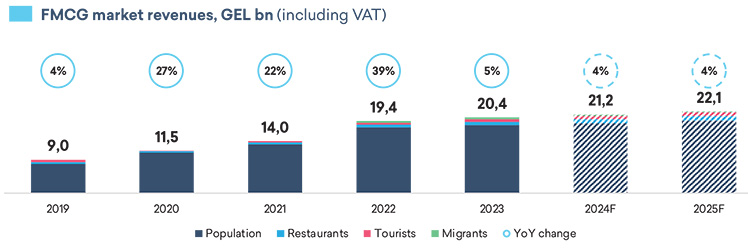

The report, which covers 2023 and five months of 2024, found that FMCG market revenues will stabilize this year after several years of strong growth.

“We expected the overall market to normalize. If we look from 2020, [growth] was 27 percent followed by 22 percent in 2021 and 39 percent in 2022. And after these three consecutive years with really high growth, we expected the market to normal-ize,” noted TBC Capital Senior Associate Andro Tvaliashvili, one of the authors of the report.

“The main argument behind this expectation was that there were several one-off events starting with the pandemic.”

For instance, there were high inflation rates in 2021, reaching around 15 percent on FMCG products. In 2022, the migrants’ influx from Belarus, Russia, and Ukraine created an influx of around 500 million lari, Tvaliashvili said. “It is not a huge number just looking at it by itself. But if we take into consideration that it was a segment that did not exist in previous years, on an annual basis, it played a huge role in the growth.”

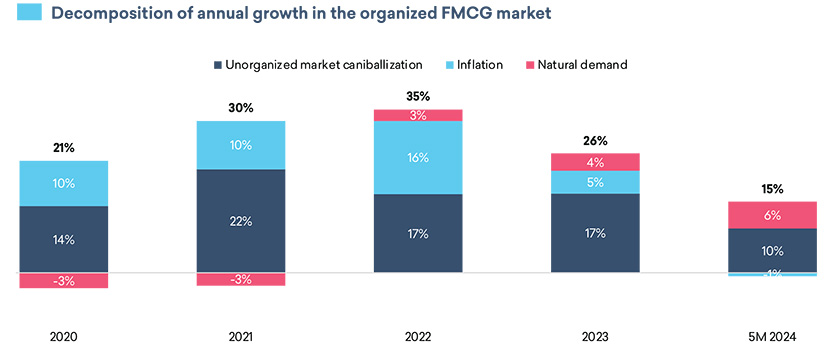

Growing organized market

The report also found that the organized FMGC market is continuing to grow on the back of the unorganized market. “The organized market grew substantially even in 2023. The annual growth rate was 26% percent,” Tvaliashvili said. “If you look from 2019 to 2022, the organized market was also growing but it was in line with the growth of the overall market. In 2023, the huge difference in the growth rates resulted in a six-percentage point increase in the share of organized market. We expect this trend to continue in coming years, in 2024 and 2025.”

He said there is an expectation the organized market to reach around 45 percent by the end of 2025, which is more or less in line with the Eastern European numbers.

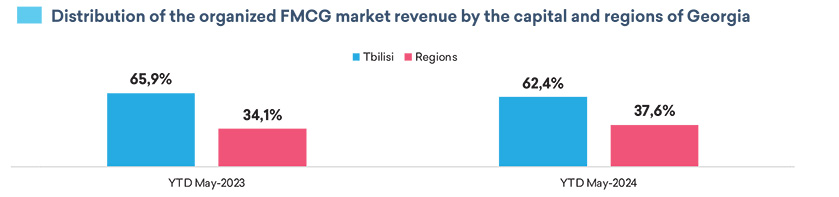

In 2023, the organized market was around 60 percent in Tbilisi—on par with Western European country averages, Tvaliashvili explained. Outside of the capital, however, the numbers are lower.

“For example, western Georgia has more large cities like Kutaisi, Zugdidi, and Batumi. The share of the organized market there is 39 percent but in eastern Georgia, the penetration numbers are really low and the organized market is only 18 percent of the total market,” he said, adding that the lower penetration in eastern Georgia is due, in part, to local consumer habits.

Tvaliashvili noted that regional expansion has driven organized market growth. “If we look at the shares in terms of reve-nue—how the revenue is broken down into capital and the regions—if you look at the first five months of 2023, the breakdown was 66 percent in the capital and 34 percent in the rest of the country. As for 2024, the share shifted to 62 percent for the capital and 38 percent in the region,” he said. “So we see the numbers evolving in the direction that going forward, regional penetration has to be the driver for the organized market.”

Untapped potential in regions

He said the number of stores is another indicator of untapped demand. “If you look at the annual change in the number of stores in Tbilisi, it is around 15 percent growth, which is still a huge number. But if we compare this number to the regional expansion, the increase in the number of stores is 34 percent in just one year. If we look at it in absolute numbers, there are around 1500 organized retail stores in the capital and it is the same number for the rest of the country. So, we see that the regions are really underpenetrated as of now.”

TBC Capital develops the annual report to inform FMCG sector players about the developing market, Tvaliashvili explained. While the report is not intended to macroeconomic analysis, it does provide some insight.

“A key takeaway is that at this point of economic development, our expenditures on FMCG products are really high,” he said. “Going forward, there is still a certain time left when these expenditures will grow compared to other goods and services, before we reach a certain level of development.”