The business of bullion: what role does gold play in Georgia’s economy?

Gold may not glitter on Georgia’s stock exchange, but it remains one of the country’s most trusted stores of value. From family trousseau to central bank reserves, gold plays a quietly powerful role in Georgia’s economy—both cultural and financial. As global prices soar, so too does local interest.

Not all those in the daily bustle around Tbilisi’s Station Square have their commute in mind – many are thinking of the price of gold, of carats rather than timetables. Their destination is the Gold Market on the station’s bottom floor, and they will be calculating the value of jewelry that they plan to buy or sell.

This market, clearly signed in large English letters, has been a fixture of the area for decades, a legacy of Soviet-era trade patterns and local traditions of craftsmanship. Here, jewelry isn’t just decoration—it is an investment, an inheritance, and sometimes, a last resort. Gold’s recent soaring price and rising economic insecurity have been driving increasing interest in its safe-haven status, a form of economic security that in times of crisis can be sold or pawned.

Gold in motion

Situated on 5,000 sq. meters on the station’s first floor, the Gold Market with its hundreds of traders is the most visible evidence of Georgia’s increasing interest in gold in the form of jewelry. Already large, it was expanded a couple of years ago to add to the dozens of traders – around 20 large stores and a multitude of smaller kiosks stretching as far as the eye can see – offering to buy or sell rings, earrings, necklaces and every other kind of ornament. Although to a much lesser extent, they also trade in silver. Beneath the market’s flickering lights and behind their counters, the traders assess customers who come in every shape, size and nationality, milling through the narrow lanes, weighing them with practiced eyes. The turnover of this multiplicity of small businesses is not officially declared.

But this is only the most visible evidence of gold’s currently growing place in the economy. Figures released by the National Bank for pawnshop business at Georgia’s microfinance organizations show that in the first quarter of 2025 they held GEL 1 billion of gold. According to the latest consolidated financial report, most of their pawn loans are secured on gold, and their value was up by GEL 306 million Q1, a rise of 41% compared to a year ago against a 35% gain in the gold price.

As a study on gold jewelry from the University of Connecticut comments, gold jewelry has for millennia played an integral part in household economies, particularly in the east where it has cultural and religious significance and there has been deep distrust of financial institutions, if they even existed. “Women in particular have benefited from the use of gold jewelry as a store of value, using it when they themselves were unable to have financial independence in any other manner,” state the researchers in Exploring the Viability of Gold Jewelry as a Diversified and Safe-Haven Investment.

Georgia reflects its geographical location on major Silk Roads and is more Eastern than Western in its gold sensibilities, cherishing jewelry both for adornment and as a form of secure wealth. Gold jewelry is traditionally seen as “a symbol of wealth, status, and family honor in Georgia, especially among women,” say researchers for the Journal of Folklore Research and the UNESCO Intangible Heritage Lists.

“In Georgia, families traditionally prepare a trousseau that includes household items and jewelry—gold earrings, brooches, rings—for a bride. This gives the woman something of value of her own that she can own and control,” Marina, one of the Gold Market’s traders says. Her neighbor joins in: “It’s like a form of insurance. If she needs money, in divorce or if one of the children is ill, she can sell or pawn these pieces.”

Global dynamics

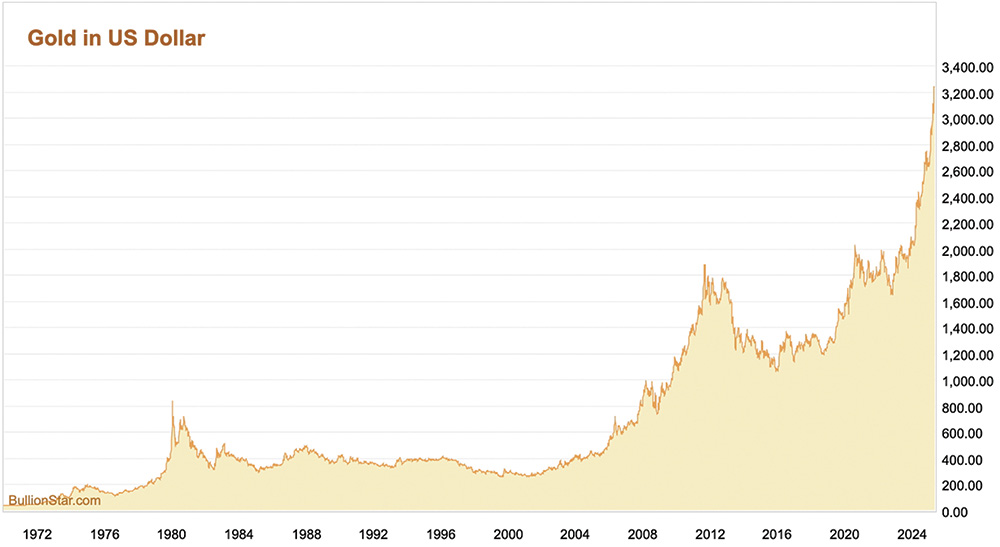

However, gold is not always a reliable haven, whatever its current status. There are periods when it fails to respond to economic crises – in the 1980s it was a disastrous hedge against inflation (one of its supposed merits). In physical form, it pays no dividends, and often the price lags those of shares.

But that gain in gold’s price of around 93% over the last five years shows why, worldwide, investors have not been discouraged. The price has continued to set multiple new record highs so far in 2025, the rise in Q1 being an average of 38% to $2860—and it has gone on rising since. Driving this is the specter of U.S. tariffs, geopolitical uncertainty, stock market volatility, and USD weakness.

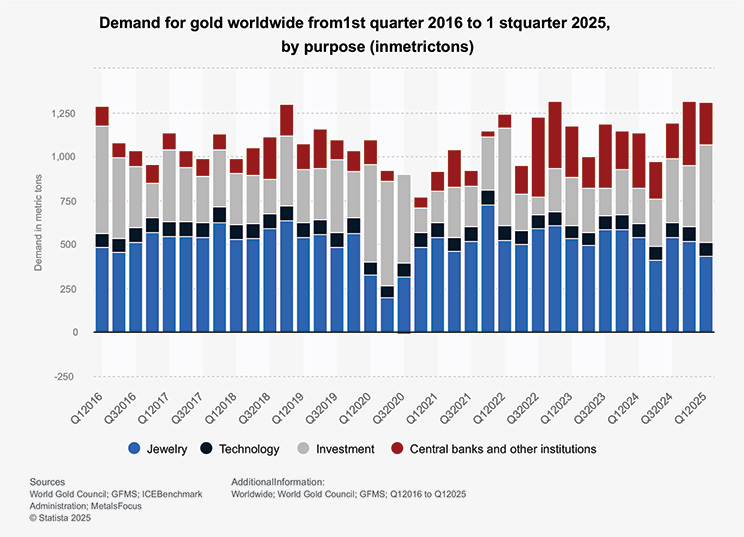

New factors have also recently been major gold price drivers globally: the development of markets for paper gold-backed investment market instruments (much more convenient than the metal itself). These instruments include gold ETFs (exchange-traded funds), gold mutual funds, and gold savings accounts, all of which track the price of gold and allow investors to gain exposure to the commodity. However, there is a need for gold to back them. Global ETF holdings expanded by 226 tons, or a staggering 1,114% in Q1 2025, bringing total ETF gold holdings to 3,445 tons, according to industry body the World Gold Council. Additionally, queuing for gold bars are major buyers in the form of countries’ central banks, which are going for gold in a big way.

From Tbilisi to Central Banks

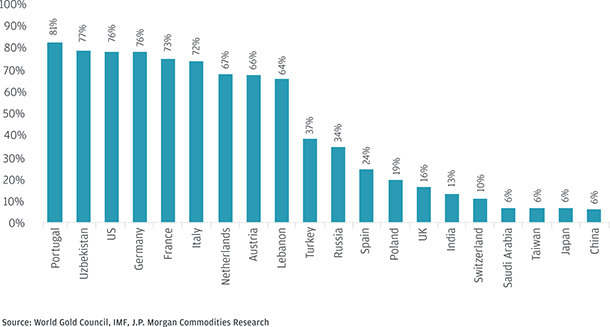

The reason for central bank buying has been predominantly to diversify their country’s reserve currency holdings away from the dollar, for both geopolitical and economic reasons. This has been accelerating in recent years, according to the latest data from the International Monetary Fund (IMF). While the share of the dollar in central bank holdings increased modestly in the fourth quarter of 2024, it still ended the year with a 0.62 percentage point decline at around 57.8%. “Add in economic, trade, and U.S. policy uncertainty and shifting, more unpredictable, geopolitical alliances and we think further diversification into gold will amount to around 900 tons of central bank buying in 2025,” says U.S. giant investment bank JP Morgan Chase in a recent report.

Globally, central bank gold holdings amount to nearly 36,200 tons and account for almost 20% of their official reserves, up from around 15% at the end of 2023, according to reported IMF data at the end 2024. The U.S., Germany, France, and Italy hold around 16,400 tons of gold combined, nearly half of reported global official gold reserves, with the U.S. holding almost a quarter of global reported gold reserves alone. Each of these four countries hold more than 70% of its total reserves in gold.

“Central banks are structurally raising the floor under prices by steadily reducing the amount of gold available for trading in the market. As a result, even during corrections, the new lows are higher than where prices were just a few weeks earlier,” states a report from another major U.S. investment bank Goldman Sachs. Its analysts believe that “…gold is likely to break more records this year.” Goldman Sachs Research predicts gold will rise to $3,700 a troy ounce by the end of 2025, with central banks continuing to buy many tons of the precious metal every month.

Georgia’s central bank is one of the many that have been buying gold to add to its reserves – foreign currency and gold used to help manage its own currency and to maintain confidence in international financial markets. It first took this step in March last year, with an initial purchase of seven tons, announcing that this was to diversify its holdings. At the end of Q1 this year, gold accounted for over 16% of reserves, worth around $715 million.

Supply strains and shifting demand

The gold experts at London mining analytics and stockbroking group SP Angel say that: “In our view, gold’s rally from 2022 lows of $1,650/oz to today’s level over $3,300/oz has been powered by foreign reserve diversification in BRICS countries, specifically China. This rotation from dollar reserves to gold has coincided with growing concerns over the West’s fiscal profligacy, with government deficits expanding year on year. We believe these two primary factors are the key drivers behind what is becoming a multi-year gold bull run.”

This persistent buying is resulting in a shortfall of gold supply compared to ongoing demand. Total Q1 2025 gold demand in value terms almost matched the Q4 record of US$111 billion, with volume at 1,310 tons. However, the supply of gold was only 1,206 tons. Mine production inched up to a Q1 record of 856 tons, with, as usual, the other major source of gold, recycling, supplying around 40% of the total. As the price has soared, demand for jewelry, dentistry, coins, medals, and industry have suffered—only electronics demand proving resilient to the recent steep rises.

Globally, although total tonnage demand for jewelry dropped to its lowest since the pandemic, higher gold prices kept total spending elevated. In fact, consumer purchases rose by 9% year-on-year, totaling $35 billion, according to U.S. gold traders Scottsdale Bullion. When measuring consumption in tonnage, jewelry procurements fell by 21% YoY. Scottsdale Bullion’s latest report added: “This sector, which accounts for nearly 50% of overall gold purchases, is likely to face more headwinds as prices continue notching new highs and experts revise their 2025 gold price forecasts upwards.”

The difference of attitudes between Western and Eastern countries towards gold makes for great differences between the returns from gold jewelry. In Western countries, where the emphasis on gold is not strong, returns on gold jewelry are equally not strong, pawn shops not taking into account the artisan markups on an original piece of jewelry and thereby disregarding a large portion of the original cost of gold jewelry,” states the University of Connecticut’s paper.

“This results in a much tighter potential return. Conversely, in Eastern countries where the emphasis on gold is strong, many pawn shops will take into consideration the artisan markup on a piece of jewelry, factoring it into the return potential of the asset. It is entirely possible to make more than the current spot price of gold in an Eastern country due to this emphasis on the artisan value of jewelry.” This can be the experience in Tbilisi’s Gold Market.

Recommendations for the sort of gold jewelry most likely to prove to be a good investment from U.S. group Curated Fine Jewelry is to for the plain gold pieces – such as chains and rings – but also to look out for well-designed items with “craftsmanship quality and famous brand names.”

The Connecticut researchers conclude that there is little benefit for most people who decide to hold gold jewelry as a short-term investment asset (although the current price record gainsay that assumption). Yet, the researchers do not take into account the lack of easily accessible banking facilities in many areas where gold jewelry is most popular – though in Georgia the major banks offer pawn broking services. Nor does it acknowledge the comfort of holding a proven safe-haven investment which can easily be converted into cash when the world is full of so much uncertainty, crises seem always to be threatening, and the local socio-economic landscape is, to put it mildly, fluid.