Georgia’s rail revival – investment interest grows as country seeks to become a transport hub

Investors are rediscovering Georgian Railways, as the rising price of the train monopoly’s Frankfurt stock-market-quoted bond shows. There has been a gain of 10% in the price in the last few weeks, with the bond starting the year at a recent high of $90.53. A major factor behind this increase is the international publicity being given to the vital place played by Georgian transport and logistics, and particularly Georgian Railway, on the much heralded east-west Eurasia cargo transit Middle Corridor route.

Logistics and transport opportunities are increasing in Georgia as shippers continue to avoid the perils of alternative land and maritime routes: a lack of insurance on the Northern Corridor crossing Russia and Houthi terrorists attacks on Suez Canal-bound traffic in the Red Sea. This is creating a huge logistical, security, and touristic challenge that is also creating opportunities for startups to contribute.

Businesses in these sectors are expanding in Georgia as ongoing domestic economic growth, positive forecasts, and increasing transit trade are creating active markets for warehousing, container lorries, and wagons to service the rising volumes of goods moving through the country. Georgia’s economy could show real growth of around 5% this year after around 7% in 2023, say the international development banks.

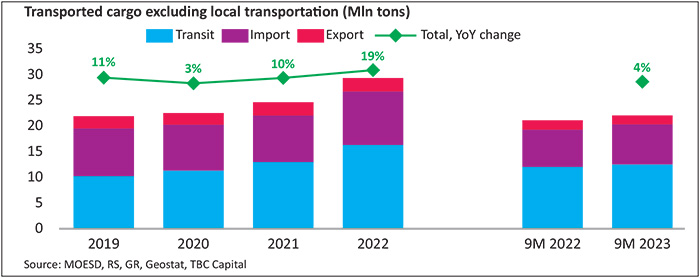

Georgia’s transport sector is thriving, with the figure for transit cargo volume in the first nine months of 2023 up 4% year-on-year, according to TBC Capital’s latest sector report, an Overview of the Transportation and Logistic Sector in Georgia (transit accounted for 57% of total cargo traffic volumes in this period). Additionally, on the World Bank Logistics Performance Index, Georgia improved its rating from 119 in 2022 to 79 last year.

Improvements that won Georgia this rating, as listed by TBC Capital, included customs, infrastructure, international shipments, logistics competence, and tracking and tracing. But the scope for further investment and management is indicated, scoring only around 2.5 on a five-point scale in the World Bank’s index. TBC Capital’s report also commented that challenges include a “lack of qualified human resources in mainly every level of the logistics chain.”

Currently, the majority of Georgian cargo is carried on container lorries rather than by rail, which will change with ongoing government transport reforms. As freight fled from the northern route through Russia, Georgian road cargo growth saw a 22% rise in 2022 and a further 14% increase in the first nine months of 2023. Containers in Georgian ports and terminals rose by 65% in 2022, following a few cuts in tariff rates, and last year overall rose a further 15%. Less encouraging were the nine-month ports and terminals freight figures, with an 8% fall. But air freight reversed recent declines and posted a 7% gain.

That overall 4% transit cargo rise was impressive as the recent pattern of movements has been uneven. In 2021 and early 2022 growth was particularly strong. Sanctions and lack of insurance drove shippers to switch their EU-China consignments away from the northern routes through Russia, after the invasion of Ukraine, to the Middle Corridor and maritime routes. But then, on finding that the multi-frontier Middle Corridor route was not coordinated, was dogged by bottlenecks at ports and borders and was expensive, they started to cut back on trans-shipments. However, TBC Capital states that despite this, 2022 transit demand overall was still up by 19%.

The scope for entrepreneurs can be seen throughout TBC Capital’s report as the transport and logistic sector’s growth trend continues. For example, the automotive fleet responsible for transport cargo “remains fairly outdated,” with the average age of trucks being over 26 years and wagons around 22 years old, even though there was a 6% YoY rise in Georgia for registered trucks (and a 12.9% increase in wagons).

In the warehouse sector, where activity was hectic, with a 161% increase in listings for rent last September and a three-fold rise in those for sale, entrepreneurs also saw opportunities. Occupancy rates reached nearly 100% in 2022. But the report notes that the “market for warehouses is mainly unorganized, comprising many players … and there is a lack of third-party providers who offer full logistic services, including inventory management, warehousing, and customs documentation.”

Actual prices for rental and sales were higher than on listings and were volatile: the actual average rental asking price for Tbilisi warehousing was up 61% in September last year from one year earlier. The sector responded by increasing supply and Tbilisi construction numbers rose by 42% in 2022, mostly for large scale warehousing. Building applications for Tbilisi diminished in 2023, but the upcoming new regulation restricting the movement of large vehicles in the city during peak hours is expected to lead to warehousing development at the outskirts of the city. Another change is that cold storage warehouse numbers showed a gain in volumes stored in owner-occupied facilities – at 36% last year compared to 2022’s 27% – as against rented ones.

Modernizing Georgia’s railway

However, as far as international investors are concerned, the most important changes in the Georgian transport sector are on the railway, where projects are in place to modernize Georgian Railway’s infrastructure; increase its capacity, speed, and safety; and raise its competitiveness for land cargo routes. The aim is to “de-bottleneck” it in order to maximize benefits from its part on the Middle Corridor Eurasian transit route. Given the choice and competitive pricing, international carriers prefer rail to road on the grounds of costs (lower fuel and driver costs), higher load volume capacity, reliability (standardized schedules), and environmental friendliness.

Modernization of the railway has been in progress for several years now, with some of the major infrastructure work, such as the construction of a nine-kilometer tunnel at the Rikoti Pass, already completed. General Director of Georgian Railway David Peradze spoke at the opening ceremony of a target increase in rail capacity from 27 million to 50 million tons. This will also require the purchase of more rolling stock, as the current capacity is about 16 million tons, according to TBC Capital, with the ongoing Ukrainian war having exacerbated the situation as maintenance and repairs have traditionally been done in Russia, Ukraine, and Belarus.

While train transit cargo volumes were up 29% in 2022, due to rerouting from the Northern Corridor, bottlenecks for transit traffic drove shippers away and last year volumes fell, leaving the transit tonnage carried at 5.9 million. However, container numbers rose last year, as did those for oil products and passenger traffic.

Revenue at Georgian Railway rose 16% to $118 million in the first half of 2023, but underlying profits were down 19% at $35 million due to rising employee costs and GEL appreciation. Since the issue of its last Eurobond in 2021, a seven-year one with a yield of 4%, replacing an earlier one with a 7.75% yield, the company’s financing costs have been halved. A “green” bond, the 2021 issue was extremely popular and was four times oversubscribed as the major development banks and institutions participated. The $500 million raised will be used partially to fund the $300 million modernization project, which incorporates buying new wagons and locomotives and modernizing the tracks and trackside infrastructure and stations.

Conservatively, assessing the impact of the modernization plan and growing domestic and international demand, international credit-rating agency Fitch has forecasted Georgian Railways’ operating revenue growth to average over 2% in the coming four years. As the company is state-owned and controlled, its bond is rated in line with those of the government.

This 2021 Georgian Railway bond, quoted on the London and Frankfurt stock exchanges, is currently the only way into Georgia’s expanding transport logistic business for all except private venture capitalists and entrepreneurs investing in the sector’s many small businesses. However, given the yield if offers and the good chance that the price will rise some more, even this bond gives only very limited access – the minimum stock market investment is a nominal $200,000, so one for funds – not private investors!