TBC Capital: Tbilisi residential real estate market sees stable first quarter

Transactions, price, and yield

Tbilisi’s residential real estate market remained largely stable and in line with forecast trends throughout the first quarter of 2024, despite a noticeable drop in March transactions, says TBC Capital’s latest market watch. The average asking price per square meter in March came in at $1,200, up 4% YoY, while the overall market was valued at $235 million, down 10% in annual terms.

Transactions were down 11% in March compared to the year prior, which TBC Capital Senior Analyst Revaz Maisuradze says is not necessarily indicative of wider shifts in the market but instead due to changes in legislation around property registration that came into effect at the end of the month. “A new law came into effect on March 26 that requires all new properties to be officially put on the market and approved by city hall before they can be sold,” he explains. “There was a noticeable drop in transactions in the last five days of the month, which could mean it took the market time to adjust to the new regulations. Preliminary data from April shows that transactions returned to their previous trends, indicating that this was most likely a one-off event as developers adjusted to the new law.”

While sales prices continued to be largely stable, average rental prices and rental yields continued to decline, down 10% and 1.4pp YoY, respectively. Maisuradze says this is line with analyst expectations for 2024: “The large uptick in demand that we saw in 2022 and partly in 2023 – mostly related to migration trends – have faded away. Therefore, we expected rental prices and yields to contin-ue a gradual downward trend throughout 2024.”

Consumer Preferences

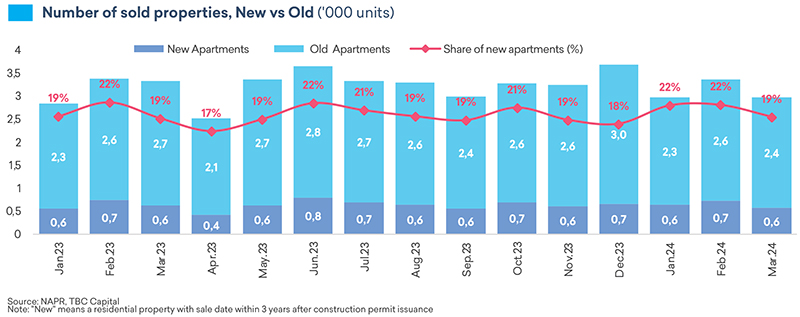

Sales of new apartments, or those sold within three years of when their building permit was granted, were down 9% YoY in March, while sales of old apartments were down 11% YoY. The share of new apartments in total sales was slightly lower (19%) compared to the previous month (22%), which Maisuradze says could also be a result of the new legislation that impacted sales of residential properties at the end of the month.

In terms of location preferences, Didi Dighomi had the highest number of residential property sales, making up 22% of total transac-tions, followed by Saburtalo with 18% of transactions.

Construction permits

The first quarter of 2024 saw a continued upward trend in the issuance of construction permits. The residential area covered by construction permits in Q1 2024 reached 337,000 square meters, up 18% YoY. This growth, on top of record annual growth of 51% in 2023, indicates that developers are still optimistic about the Tbilisi residential market. Maisuradze says that these continued positive expectations from the first quarter of the year could also have been boosted by the EU’s decision to grant Georgia candi-date status at the end of 2023. “While we didn’t see a noticeable shift in sales prices as a result of the December announcement, the overall positive impact on the investment climate and economy could have played a role in continued optimism and demand expectations from the sector.” He adds that “while analysts should continue to closely monitor the number of permits being issued,” that “current levels of demand are high enough to absorb the supply of new residential projects.”