Whither the lari? Georgian banks, businesses take a look at 2022

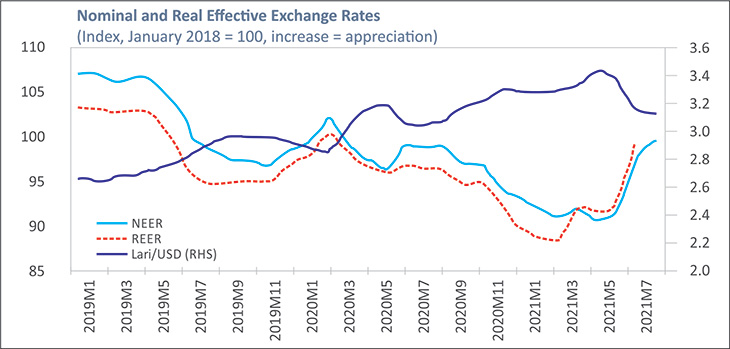

The lari’s value against the dollar has bounced turbulently in the last year, plummeting to 3.44 GEL/USD in May and reaching a high of 3.06 in August. Analysts express cautious optimism for a more stable lari as they look towards 2022.

The volatility of the lari has been a major hindrance for much of Georgia’s business community this summer, according to a Q3 survey carried out by the Business Association of Georgia (BAG). The BAG Business Climate Index, which examines the views of member corporations and businesses for the next six months, found that among the three-quarters who were experiencing problems, 78% of its major manufacturing members and 68% of the total membership were concerned about lari volatility.

While the economic and capital flow fundamentals would seem to indicate currency stability into 2022, many businesses, having been burnt in the past, are reluctant to believe that the lari can break out from its years-long trend of depreciation against the dollar. This is indicated by the fact that 55% of BAG’s members now expect the lari to depreciate, up from 49% in Q2. This is distressing for the population since so many identify the dollar-lari rate as the key barometer for the country’s economic health.

Cautious optimism

Yet as tourism recovers, there is more optimism among professional watchers of the economy and currency, including BAG, investment bankers Galt & Taggart and TBC Capital, and international rating agency Fitch as well as the National Bank of Georgia (NBG) itself. One indicator that the volatility causing Georgian businesses so much concern may have come to an end (for now, at least) is that international data group Trading Economics now carries a forecast of around 3.2 GEL to the dollar until July 2022 – not much changed from current levels.

Many of the factors that were pulling down the lari have reversed, and the economy has “rebounded at a speed exceeding even the most optimistic scenarios,” as TBC Capital’s chief economist Otar Nadaraia described. TBC Capital’s range suggestions for the months ahead are 3 to 3.3 GEL against the dollar, and 3.69 to 3.86 GEL against the increasingly important euro. More attention should be paid to the euro, believes TBC’s chief economist, as its rate has been less volatile against the lari than the dollar. The EU is also the source of 40% of the money sent home this summer by Georgians abroad as well as 23% of trade in 2020 (making it Georgia’s top trade partner). EU tourist inflows are rising rapidly as well.

At Galt & Taggart, Head of Research Eva Bochorishvili says “We do not expect sharp volatility in the FX market in 2H21, with the GEL ranging from 3.1 to 3.2 against the dollar in this period.” She added: “We see GEL appreciation potential in 2022 amid an expected full recovery in tourism, and we assume tourism will recover to 36% of its 2019 level in 2021.” Further stability is expected from a reduced budget deficit and continued improvement in the economy.

However, history gives reminders that it is essential to be aware of what could bring another lari reversal. “Risks which may delay GEL appreciation are possible new variants of COVID-19, a vaccination slowdown, political instability, and turbulence in regional and global financial markets as well as tightening in financial conditions,” she adds.

At BAG, too, there is optimism about an end to lari volatility – for the rest of this year, at least. Economist Natia Bantsuri points to numerous factors backing the currency: the effect of the money flowing into Georgia from tourists and trade, and the sizable economic and fiscal stimuli brought in to counter the impact of COVID-19. The mortgage subsidy program is expected to create demand for the lari, and government spending is typically higher in Q4. She also notes that for financial market investors (foreign as well as domestic), the lari’s relatively high interest rates, at around 11% or higher on some deposits, make it attractive to the yield-hungry, given that international rates are frequently, as in the US, below 1%.

However, she too voices the proviso that “risk factors are always in place,” among which must be counted the vulnerability of small and very open economies such as Georgia’s, whose shallow financial markets offer little protection for their floating exchange rates. Events that could bring renewed pressure on the lari include concern about management of the pandemic and new waves as well as delays in economic recovery. But, she notes: “The policy response to these changes is no less important.”

Possible scenarios

A range of currency scenarios – baseline, upside and adverse – have been published by the NBG. Its prime preoccupation is the control of inflation, with a current target of 3% (rather far from the current, pandemic driven, 12.8% in August), and it steers its monetary policy and interest rates towards achieving that goal.

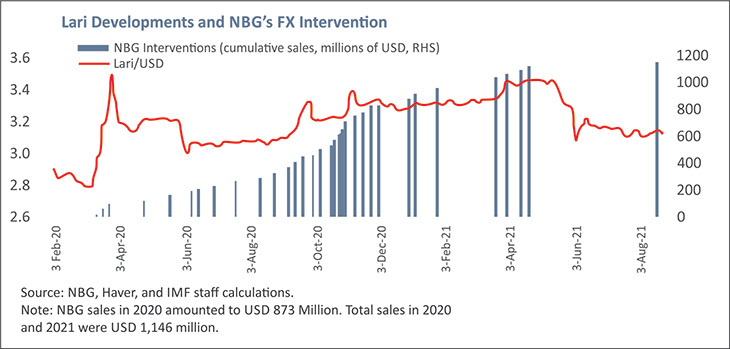

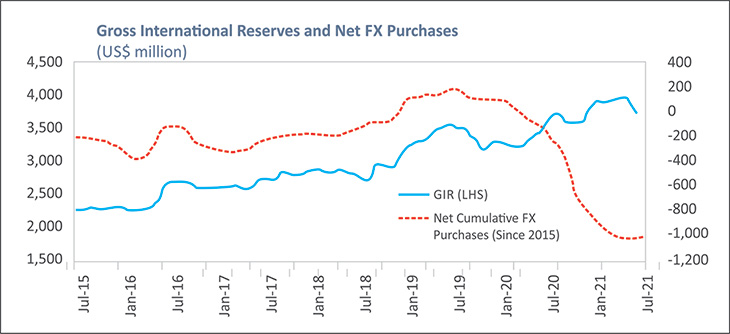

“The NBG has intervened in the foreign exchange market extensively in order to alleviate excessive volatility of the exchange rate and supplied FX (foreign currency) liquidity (around $916m) to the market. However, the aim of FX interventions never was to set the exchange rate at any particular level,” it states.

The intended purpose of the lari support operation (considering 2021’s spending, it amounted to $1.12 billion) was to counter the inflationary effect when it was dumped heavily as a result of the 83% drop in receipts from pandemic-hit tourism, shrinking trade and industrial activity, and recent decline (50%) in major cross-border foreign direct investment. Nevertheless, its “monetary policy rate” (the key interest rate), which was recently increased to 10%, is vitally important for Georgian and foreign borrowers and savers (and it is not shy of raising it, as the bankers comment). Thus, the NBG influences the currency via both this interest rate and its direct market actions, making it one of the important players in currency flows and lari exchange rates.

The NBG aims to send clear signals, publishing guidance that relatively high interest rates (compared to other frontier markets) will continue for some time yet. Last month, after raising its monetary policy rate when inflation ratcheted up to 12.8%, the NBG stated that “in the baseline scenario, inflation will remain above the target this year, which is largely due to sharply higher commodity prices in the international market.” It added that because of the risks, “monetary policy will remain relatively tight for a relatively long time. The pace of exit from the tightened monetary policy regime will depend on the reduction of inflation expectations.” However, under the assumption that inflation will fall next year, current market expectations among commercial banks are that interest rates will also be heading down, with expectations ranging from cuts of 1.5 to 2% off the existing 10% by the end of 2022.

Another action taken by the NBG that has helped support the lari includes incentives for the banks to promote de-dollarization of deposits, which has eased demand for dollars, notes Galt & Taggart. Additionally, while its major auctions attract headlines, the NBG has also smoothed the thinly populated lari market with smaller auctions to prevent disruption by corporate trade-linked buying and selling.

In its base-line scenario for the lari (which has real GDP growth at 8.5% for this year and 4% for 2022 based on rising domestic consumption), the NBG’s August Macroeconomic Forecast Scenarios concurs with the banking economists in its prediction of exchange rate stability. It foresees that inflation will start to decline next year, allowing interest rates to fall, and that economic growth and returning tourists are already reducing the burden of the large foreign debts noted by Fitch. “Consequently, the vulnerability of the domestic economy to external shocks will decrease, and the sovereign risk premium will remain at its current low level.”

In its other possible scenarios, a positive outlook shows an immediate strong global post-pandemic rebound that would spur increased investment and trade demand. In that case, Georgia could see “GEL gains in value against the US dollar by 3% in the rest of 2021 and by another 3% in 2022.” However, if the global pandemic is not contained and restrictive measures last into late 2022, delaying international economic recovery, the NBG’s worst case scenario outlines a picture in which risks to Georgia could bring the lari down 10% this year and 5% next, although 2023 could see this depreciation reversed.

Of course, as the economists observe, Georgia remains vulnerable to potential “shocks” from a worsening pandemic, soaring commodity prices, elections, and the economies and troubles of neighbors. However, encouragement for international observers is coming from a look at the sums that indicate currency flows are building up in the lari’s favor and backing is coming from good international opinion of the NBG’s financial risk management. This includes international rating agency Fitch, even though it notes the concerning bills Georgia faces for its mountain of foreign financing. Currently, net foreign debt is 77.5% of GDP compared to international peers’ average of 18.7%.

Fitch has upgraded its outlook for Georgia, a vital score since its opinion dictates the price the country pays for international market funds. It points to the positives of money coming in from “growth in remittances, goods exports and a gradual return of tourists.” And Georgia’s friends have stepped in to help. Fitch added in its August review that the country’s higher financing needs were accommodated by “strong support from official creditors” with international donors meeting “nearly all of the government’s external financial needs.” The report notes that their confidence was engendered by “a credible policy framework.”

Other positive financial indicators highlighted by Fitch include the fact that the money available to the NBG to manage the lari has risen, helped by donors and the national bank’s increasing use of sophisticated strategies to steer currency flows. The country’s foreign currency reserves now stand at $4.1 billion. It also notes that the gap between money coming into the country and that going out is expected to drop from 12.4% of GDP last year to 6.8% this year. It is expected to narrow further to 3.3% by 2023. This is on the back of money inflows from tourism’s recovery, sustained donor funding, and level foreign direct investment.

Increasingly sophisticated strategies are also being suggested to companies by their bankers, including deploying currencies of the neighbouring countries with which they are familiar to fully hedge the risks arising from lari volatility. TBC notes that Georgia has shown a propensity to save in dollars but borrow in lari. Certainly, borrowers with a lari income stream should have debt in the same currency, says Otar Nadaraia. However, especially for longer-term debt, high lari interest rates are an issue, and USD or EUR loans with lower rates are therefore preferable. He suggests a strategy of multi-currency borrowing, using a basket of currencies, could be a better solution for achieving a balance between the opportunities and risks: the choice reflecting the countries with which a company is trading, the availability of attractive credit costs, and assessment of the relative risks.

He suggests that the Russian rouble or Turkish lira could be incorporated in a basket, together with the euro. This basket “bears a much lower rate and at the same time largely mirrors the lari, especially over longer periods.”

He adds it is noteworthy that the GEL exchange rate (as well as rates of other major currencies in the region) appears to be more stable against the EUR than against USD, especially over relatively longer periods. Therefore, “the euro should have more weight (in a basket) as compared with what would be implied from the Euro-area share in Georgia’s trade in goods and services and remittance inflows.” He notes that: “This idea could be also interesting for investments in high yield GEL instruments for those with EUR or USD income streams.”

____________________________ ADVERTISEMENT ____________________________